How to buy Gold Bonds?

Before we jump on how to buy gold bonds we need to get a clear understanding of what exactly we mean by a gold bond. Yes, it is an asset in which one can invest money and hope to earn a profit, but again what is this asset? Let us understand that first. In the later section, we will check out which bank is best for Sovereign Gold Bond.

What are Gold Bonds?

Gold bonds are government securities that are represented in gold denoted by the unit grams. It is a substitute for tangible gold and is handed out by the Reserve Bank of India on the behalf of the Indian government. You can purchase this bond by paying in cash and on withdrawal you are again paid in cash as gold is just the underlying asset in the case of gold bonds. The valuation of a gold bond is done on the basis of an average closing price of the previous three working days of 999 purity gold as stated by the Indian Bullion and Jewelers Association. Gold bonds first debuted in 2015 and ever since then are issued at regular intervals in tranches.

How to buy Gold Bonds?

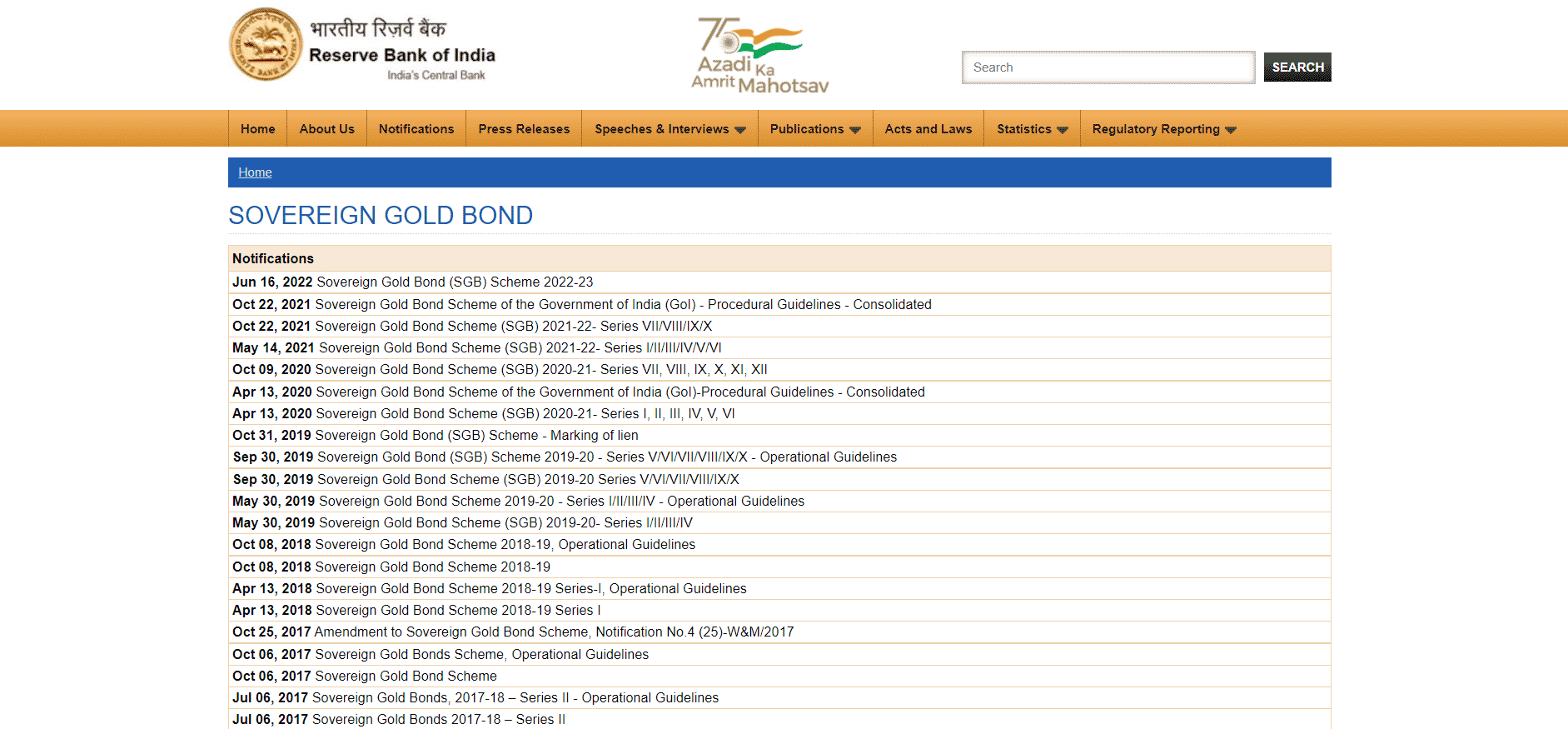

When the government of India green lights permission to open subscriptions for gold bonds, the Reserve Bank of India releases them in tranches, and for the years 2021-2022 there are no dates left as the four issues were all made and from series VII to series X have all been issued. If you wish to sign up for a gold bond, then you can fill in the application of the bank providing the bond or from the designated post office. You can also download the form from the website of the Reserve Bank Of India. There are also a few banks that allow you to apply for gold bonds online. To apply for a gold bond the PAN number provided by the Income Tax Department of India is very necessary, you can’t proceed without it. Also, the gold bonds are sold through branches or offices of Scheduled Foreign Banks, Designated Post Offices, Nationalized Banks, Scheduled Private Banks, and Stock Holding Corporation of India. Certain criteria need to be met to be able to get gold bonds, simply applying for it does not guarantee getting them. For those that apply for bonds online, the valuation of their purchase is less, their bond valuation is less by 50 rupees for each gram.

Who can buy Gold bonds?

People who are residents of India as stated under the Foreign Exchange Management Act 1999 are eligible to buy gold bonds. An individual can buy gold bonds and so can any Hindu Undivided Families. Trusts, universities, and charitable institutions can also buy gold bonds. Minors can also invest in gold bonds; however, a guardian needs to buy and hold it for them. If a person after buying a gold bond changes their base to another country then they can have their holdings till it’s time for early redemption or maturity.

RBI Gold Bond

It’s the government of India that has the power to signal the issue of gold bonds. RBI can only act in the case of gold bonds once they have permission from the Government of India. RBI gold bond would require a person to submit identity proof like an Aadhaar card, PAN or TAN number, passport, or voter ID. Once it is submitted, the KYC process will be done by the agent, post offices, or bond issuing bank. The bond is issued in the denomination of 1 gram and so on. Also, you can start investing in gold bonds by purchasing a bare minimum of 1 gram worth of gold. Which is also the minimum quantity you can invest in. The highest you can get is a gold bond worth 4 kg of gold in a fiscal year. Also Read: Tanishq Digital Gold Scheme

Gold Bond Price

After understanding how to buy Gold bonds, let us learn about its price. The first tranche of the gold bond of 2022 had an issue price of 5,091 rupees per gram and for people applying online, it was 5,041 per gram. Gold bond price is never fixed; it is different each time around depending on the calculations made by the concerned body. The second tranche of the gold bond of 2022 opened on 22nd of August and was available till 26th of August.

Gold Bond Interest Rate

The Gold Bond Interest rate stands at 2.5% annually which is more than what you get when you invest in physical gold. The interest is paid to you once every six months based on the nominal value. The gold bond takes 8 years to mature; however, after the fifth year you can redeem it prematurely. Ever since gold bonds have come into existence they have enjoyed a lot of popularity and even the COVID years could not dampen their demand. If on maturity you end up making any capital gains from your gold bond then you should know that it is tax-free which is beneficial for you. Lastly, your gold bond can be used as collateral against a loan from the bank. Now let us learn which bank is best for Sovereign Gold Bond.

Which bank is best for Sovereign Gold Bond?

Which bank is best for Sovereign Gold Bond is a very subjective question because there is no differentiation factor here to compare them against each other. The only real option you have here is to check which banks are issuing Sovereign Gold Bond and if the bank that you have an account in is issuing a gold bond then it is better to go with your own bank. Otherwise, you check for the issuing banks and select anyone as per your preference. However, it is best if you check for a bank that allows you to purchase gold bonds online and go with that bank because then you get a benefit of 50 rupees per gram which might make up a significant difference.

Features of Gold Bond

After covering which bank is best for Sovereign Gold Bond and how to buy Gold bonds, let us go over some of the features of gold bonds.

Denomination

The gold bonds are available in denominations of gold starting from 1 gram. This is also the smallest quantity that you can purchase of a gold bond. From here, the gold bonds can go up to 4 kg equivalent to gold, giving the buyer flexibility as to how much they wish to invest. Trusts, charitable organizations, and other such institutions can invest in up to 20 kg worth of gold.

Holding

You can go about holding your investment in an old-school way by having it in paper form, or you can go the new way of holding your investment in a Demat account. As per each user’s convenience, they can hold their investments in either of the two ways.

Flexibility

Buying a gold bond is nothing like signing up for an IPO. There the price band and size band are both decided by the company issuing shares but in the case of gold bonds the price is in the hands of the Indian Bullion and Jewelers Association and the size of your investment is totally for you to decide. An individual or a Hindu Undivided Family can sign up for as much as 4 kg worth of gold in gold bonds and this makes gold bonds very flexible to invest in.

Earning

When you invest in gold bonds you sign up for receiving interest twice a year, that is once every six months. Also, the interest rate is 2.5% annually and is paid on the nominal value. The return is directly associated with the prevailing price of gold as per the market.

Safe investment

There are many advantages to investing in gold bonds over gold and one of them is the safety factor. Gold can be stolen as well as brings with it the worry of storing it, however, with gold bonds you don’t have to bother about storing it away in some locker, and nor do you have to worry about it being stolen. Also, gold bonds are government security and so you need not worry about it.

Authentic

Real gold may or may not be pure as you might be fooled by the seller, but the gold bond is always 100% pure because it is government security and they can’t afford to make any blunders.

Maturity Options

A gold bond takes 8 years to mature at the end of which term you get your money. However, in the 5th, 6th, and 7th years you can prematurely end your investment by withdrawing from investment on the day that you are supposed to receive interest.

Tax

Interest earned on gold bonds is taxable as per the IT Act of 1961. Any capital gains made from the gold bonds are exempt from any sort of tax. For long-term capital gains generated investors are given indexation benefits.

Redeeming

The price of the redemption of gold bonds is based on the average price of the last three days of the 999 purity gold as stated by the Indian Bullion and Jewelers Association. Also Read: How To Invest In Foreign Stocks From India

Some other benefits Gold bonds

Along with the features we mentioned above, you also get the following benefits when investing in Gold bonds.

Transferring and Gifting: Gold bonds can be transferred or gifted to others by you. The only thing that you need to make sure of is that they meet the eligibility criteria. If everything is in place, then there should be no issues with transfer/gifting. Collateral: Your gold bond can also act as collateral against any loan that you want to take, making it useful in more ways than one. Multiple payment options: You can purchase a gold bond and make payment for it in more than one way. Cash, Demand Drafts, cheques, or electronic transfers are all okay, making the process easier and more flexible for the buyer. Nomination: You can nominate an heir for your gold loans just like you can nominate for land. So you need not worry about your gold bond going to waste as your next in line can still benefit from it. Trading: Gold bonds can be traded on the stock exchange if the Reserve Bank of India notifies as such. Buyers: Individuals, Hindu Undivided Families (HUF), trusts, universities, charitable institutions, etc. can buy gold bonds. You need to be an Indian resident to be able to buy a gold bond. Simple KYC: By providing an Aadhaar card, PAN card, Voter ID, or Driving License you can get your KYC done, and then you can purchase a gold bond. Easily Issued: A gold bond is issued by the Reserve Bank of India on the Government of India’s behalf as per the GS Act of 2006. Once you have successfully purchased a gold bond, you get a holding certificate in paper form which can also be converted to Demat form.

Why should you invest in Gold Bonds?

If you are not willing to invest in gold bonds then maybe you should focus on these bonds to understand why you should.

You should invest in gold bonds because they are safe in nature. Unlike gold which has physical value, gold bonds act as stored value and so you don’t need to worry about it being stolen. Gold bonds make it possible to put money into gold without bringing the risks of holding real gold. Gold bonds don’t have any expenses and they pay you interest every six months. Also, the gold bond is issued at an average price and the maturity value is calculated based on the valuation of pure gold which is again beneficial to the investor. You can diversify your portfolio by investing in gold bonds and it also brings down the risk factor in your portfolio as it is a stable and small-risk investment compared to most other assets. You need not make huge investments; you can purchase as little as 1 gram of gold when opting to buy gold bonds. If you redeem your investment after 8 years then there is no taxation on your capital gains and if you redeem your investment anytime after the 5th year then you can score indexation benefits. Your gold bond can also become collateral for you against any loan you want to take.

Why should you not invest in Gold bonds?

If you are already thinking about investing in gold bonds, then maybe you should look at these points and be a little careful about investing in them.

The maturity period of gold bonds is not that attractive and is very long at 8 years. Premature redemption is also only possible after 5 years and comes with its own flaws. Like other assets, gold bonds are not buyable at any time of our choosing. The government of India green lights tranches and it is then that the Reserve Bank of India releases them. Gold value is usually stable, but the prices do occasionally drop significantly and this can cause you to make a loss in your capital when investing in gold bonds.

We looked at how to buy gold bonds, RBI gold bond, gold bond price, gold bond interest rate, gold bond scheme and which bank is best for Sovereign Gold Bond. There is no doubt that gold bonds are one of the more safe assets that carry less risk. However, this safety paired with its long-term maturity period makes it an uninteresting option for many. Now that you have all the necessary points to consider, you can sit and ponder about gold bonds and whether or not to invest in them.