Truebill vs Mint: A Detailed Comparison

Money saving apps have become increasingly popular. Due to the rising price of things, the new generation is keen on managing their money in a better way. These apps are convenient and work like any normal app. Let us now begin our Rocket Money vs Mint comparison by learning about Rocket Money and Mint.

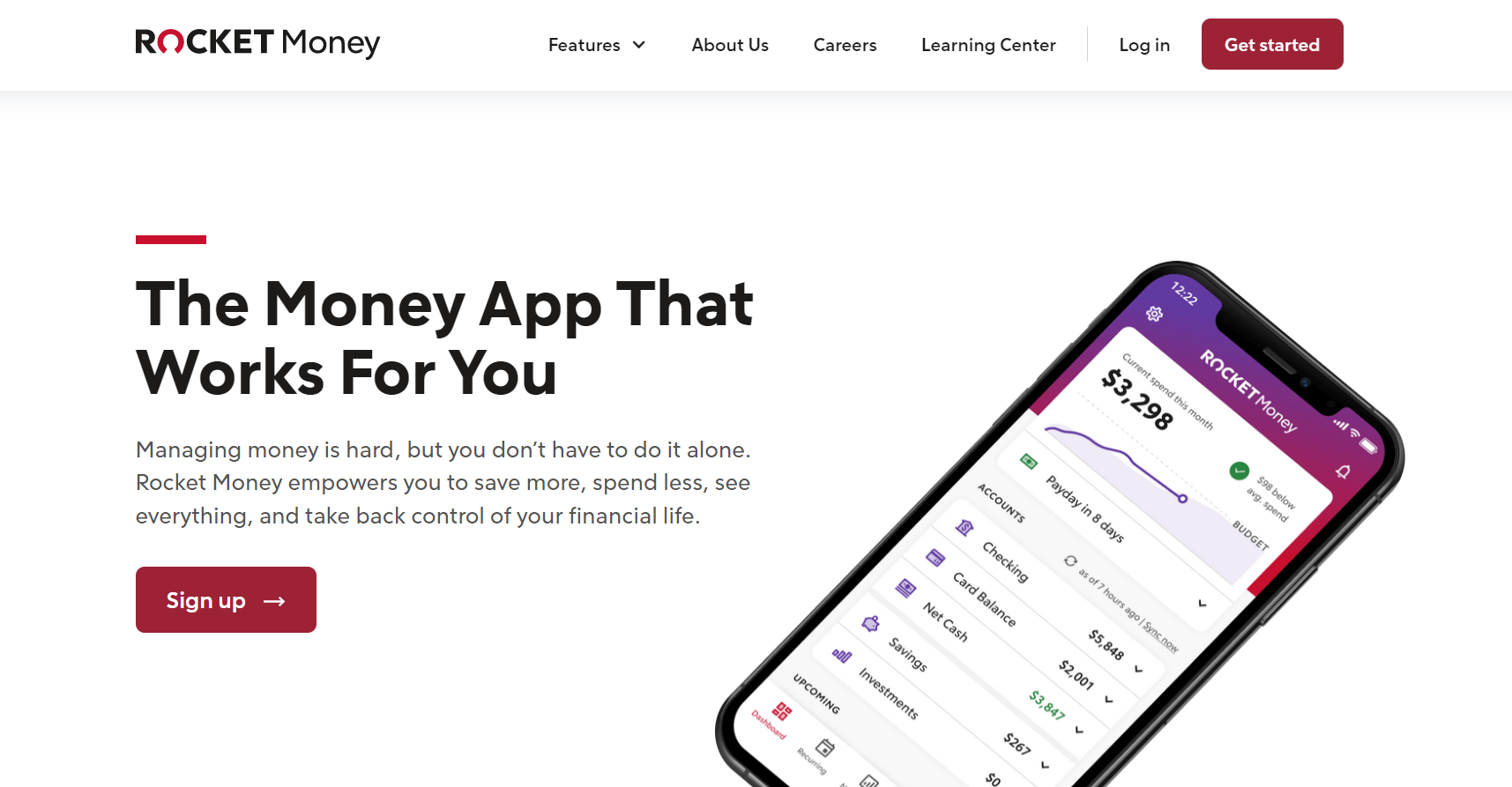

About Rocket Money (Previously Truebill)

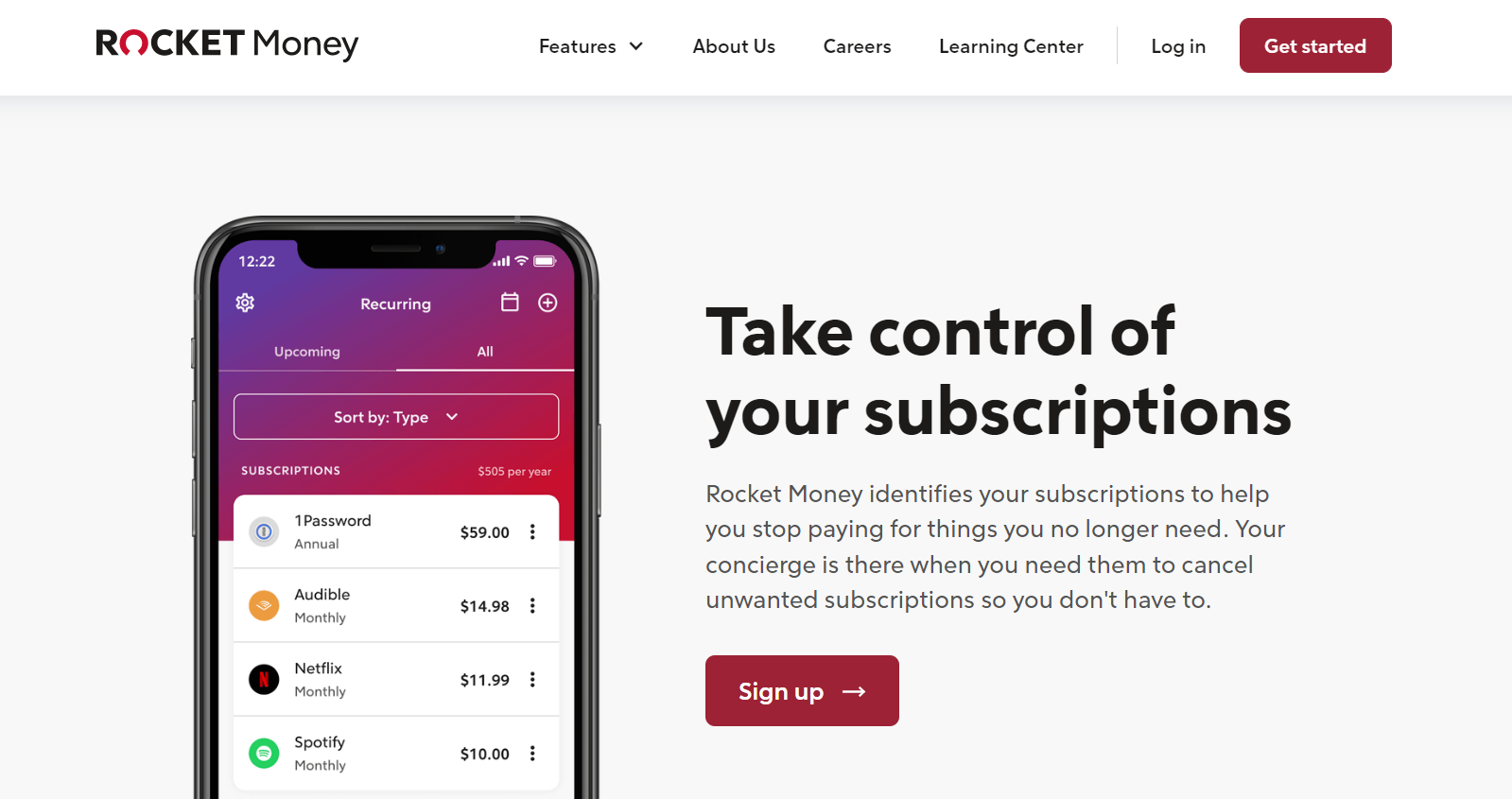

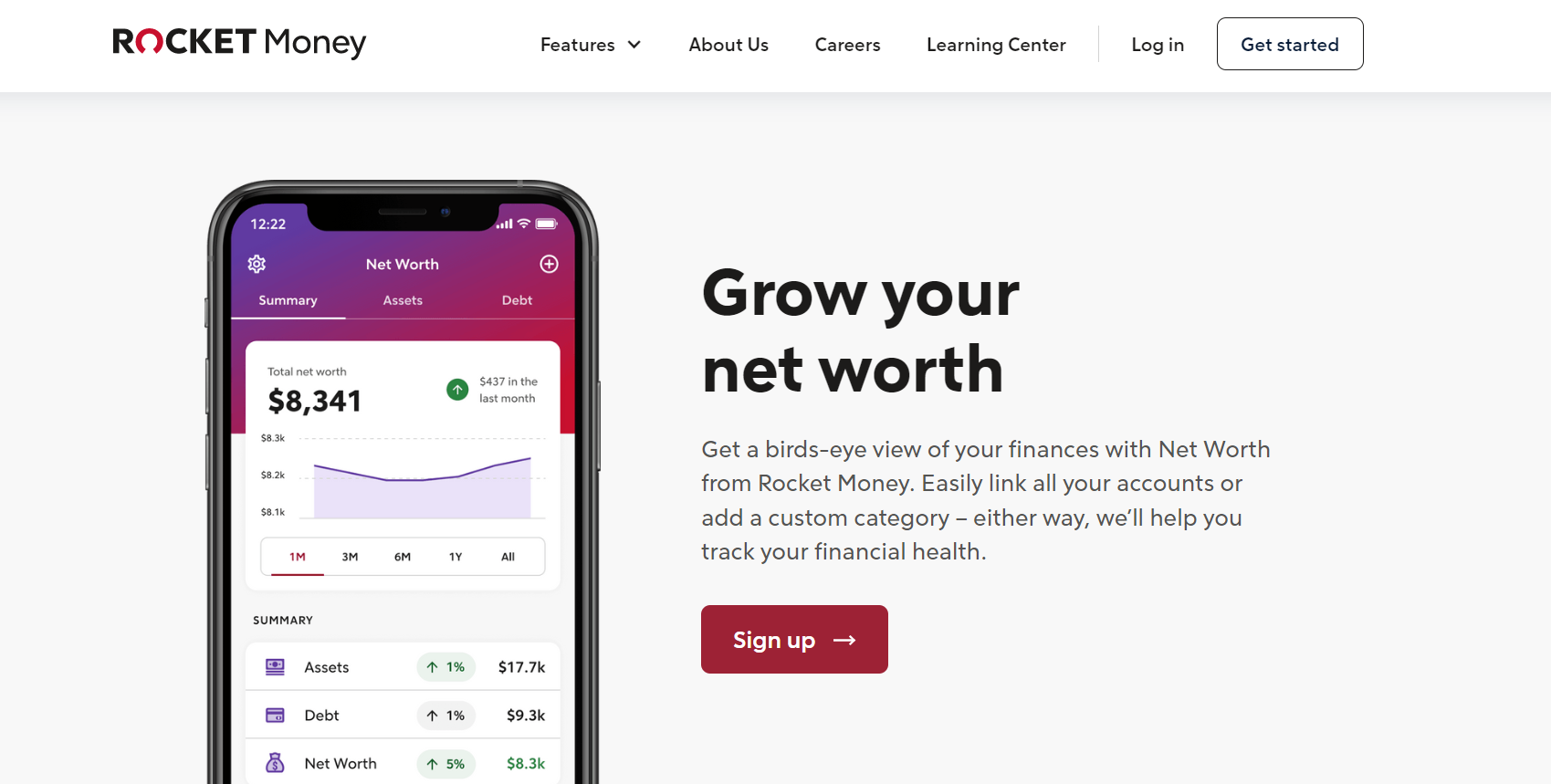

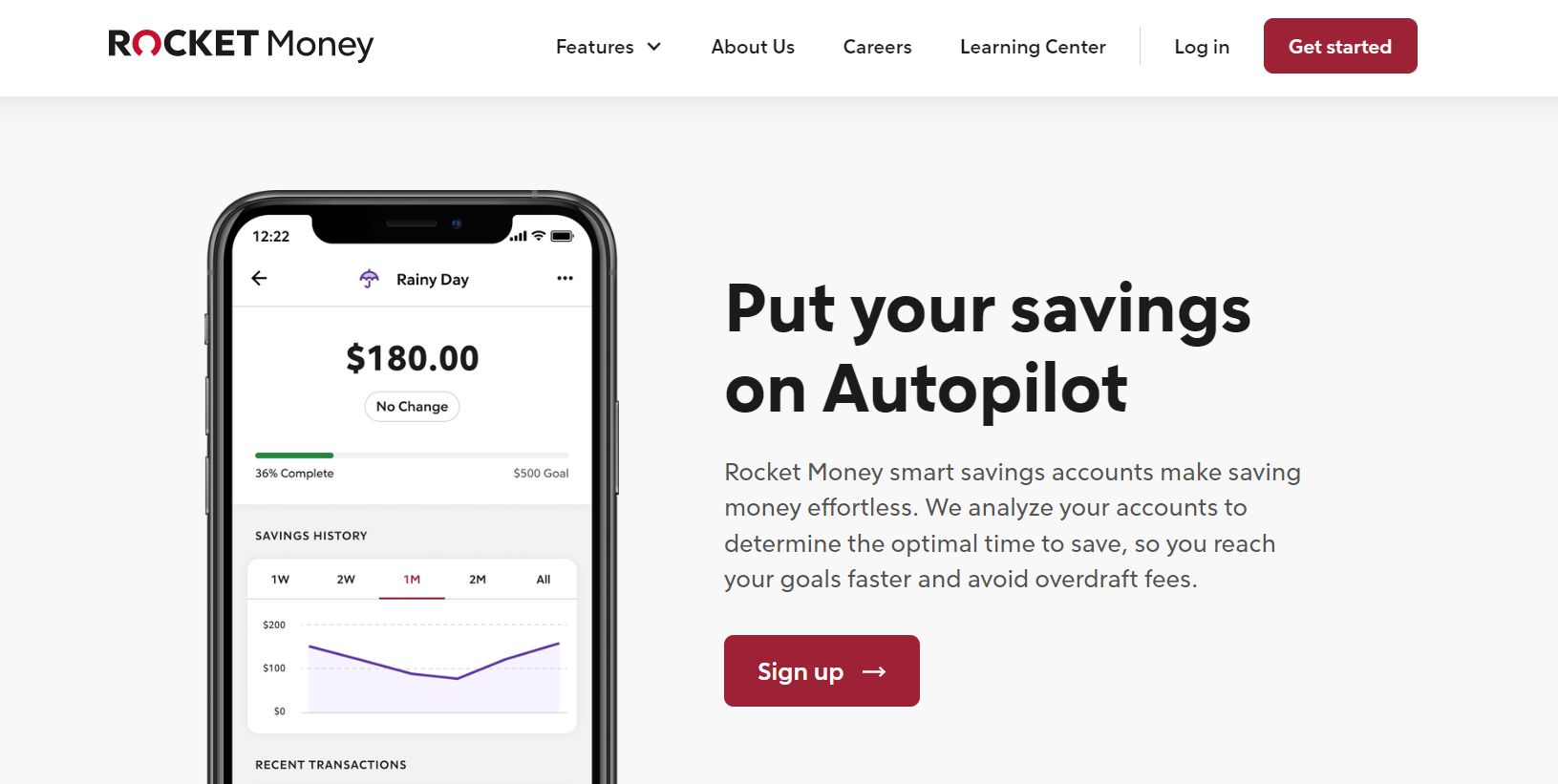

Launched in 2015 as Truebill, this money-saving platform is today known as Rocket Money. The platform has more than 3.4 million users who have in total saved more than 245 million dollars using this app and seen more than 155 million dollars being canceled from unused subscriptions. The app has a 4.5-star rating courtesy of more than 22,000 ratings that it has gotten. The team behind the app claims that they can help you save money by empowering you to save more and spend less. The app helps you cut down on your subscription costs by tracking your subscriptions and canceling them for you. Using the app you can constantly check where your money is going and the app also alerts you regarding important events so that you don’t miss out on your targets for stuff like an emergency fund or vacation fund. The app also comes with an autopilot feature where the app takes charge, learns your habits, and helps you save money on stuff without you having to think about it. That’s not it the app also helps you with tracking and understanding your credit score. Using the app you can also get the best rates on your bill by negotiating and lowering the amount on your existing bills. You also can set up your budget that the app looks at and keeps track of to make sure you stay in line just like a fitness tracker. Using the app you can also look at your assets and debts in one place to help you get a better understanding of your financial position. Lastly, the app is available to download on the App Store, Google Play Store, or usable through the website.

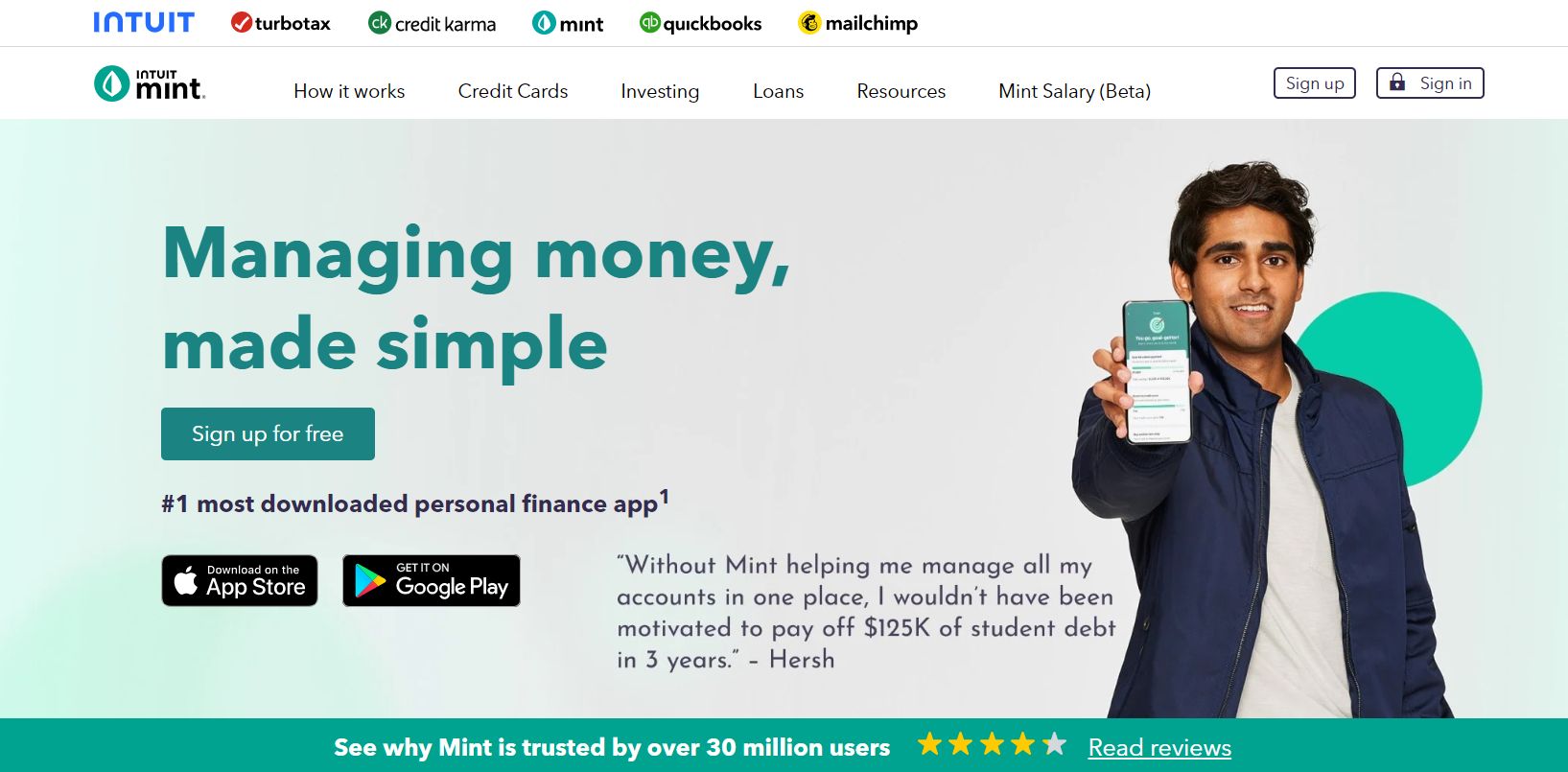

About Mint

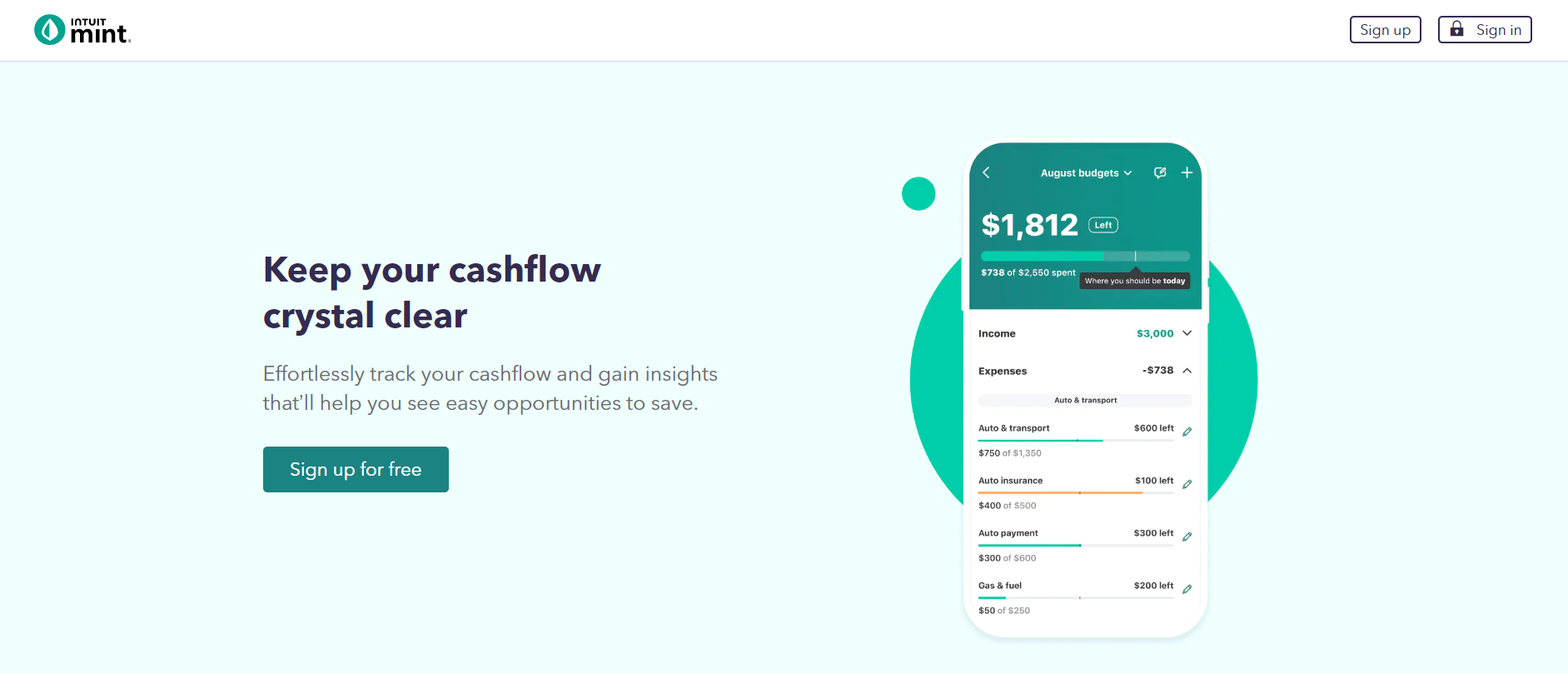

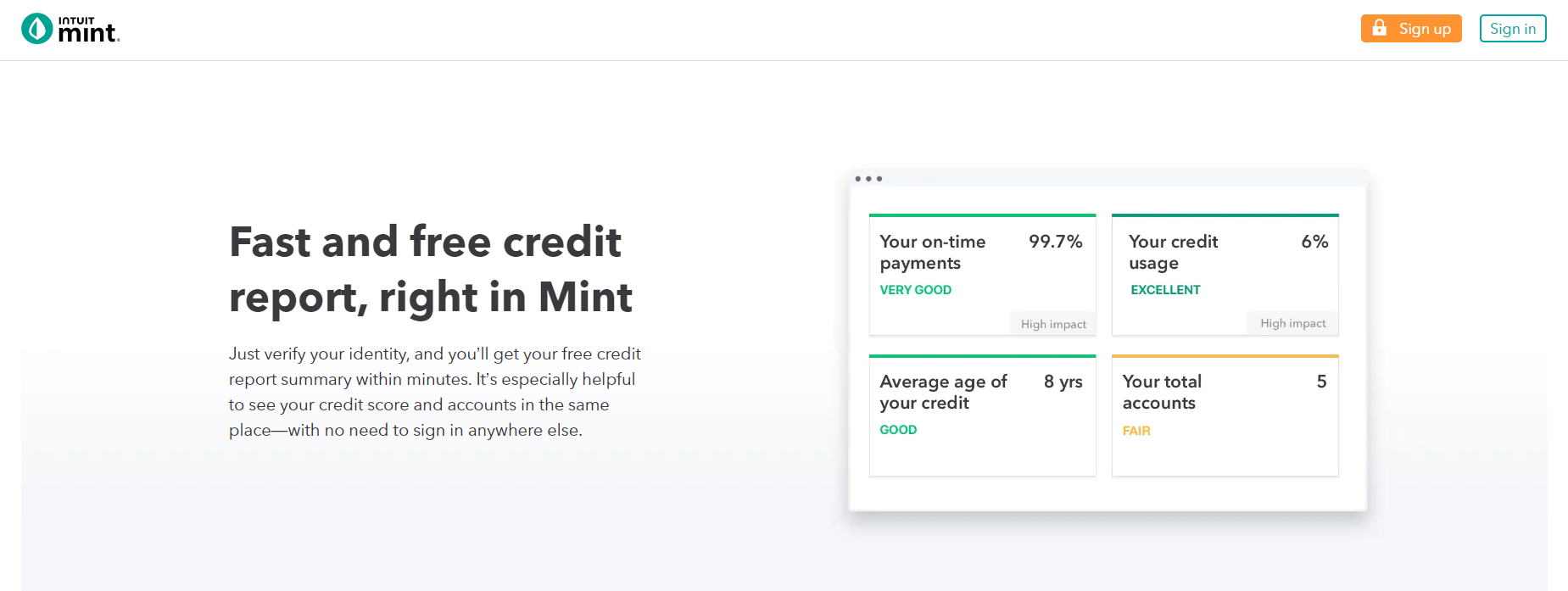

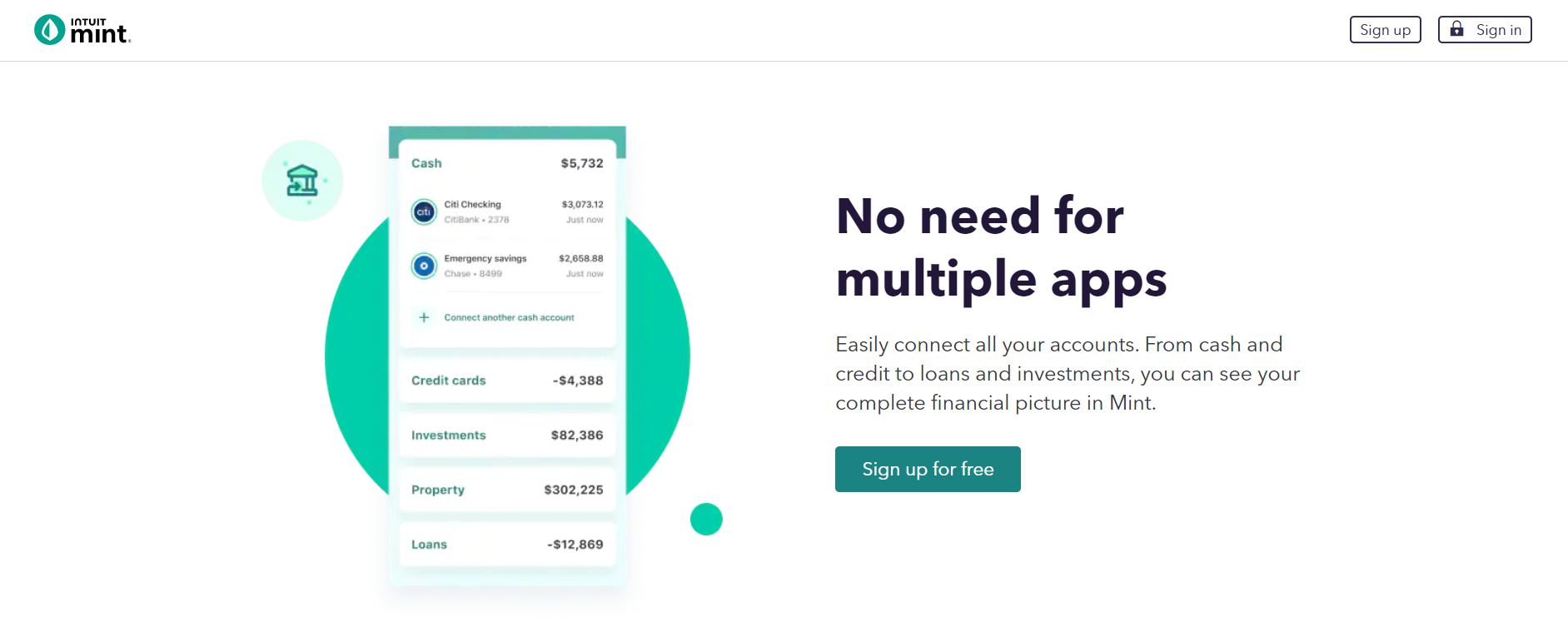

Mint is another Finance app that claims to make managing money simple and it was created in 2006 before being acquired by Intuit in 2009. With a rating of over 4 stars, the app claims to be the number 1 most downloaded personal finance app. Using this app you can make sure all your incomes and expenditures are shown in one place. This means you can now see your P and L account at any time and get a better understanding of your financial situation. The app claims to have helped people save a combined amount of more than 2 million dollars to date. Mint also has a very secure system in place which means that you don’t have to worry about your money once you put your trust into this app. The app is available on the App Store, and Google Play, and usable through the website. The app can also be used for checking your credit score for free and you can monitor the same. Apart from that the app also has a bill payment tracker, budget goal tracker, budget alert feature, and offers and tips on credit cards, loans, insurance, student loans, etc. The app also gives you access to various calculators like retirement calculator, loan calculator, travel budget calculator, and grocery budget calculator among others which you can use to plan your spending/saving on various items. Now that we know about both Truebill and Mint it is time for the Truebill vs Mint comparison.

Truebill vs Mint

The comparison that we are about to see consists of various aspects. Both the apps will be compared based on some common features that they are expected to offer and they will each be given points for being the better app in any category. The app with more points, in the end, will be the one that is the better alternative. So let’s begin with Truebill vs Mint comparison.

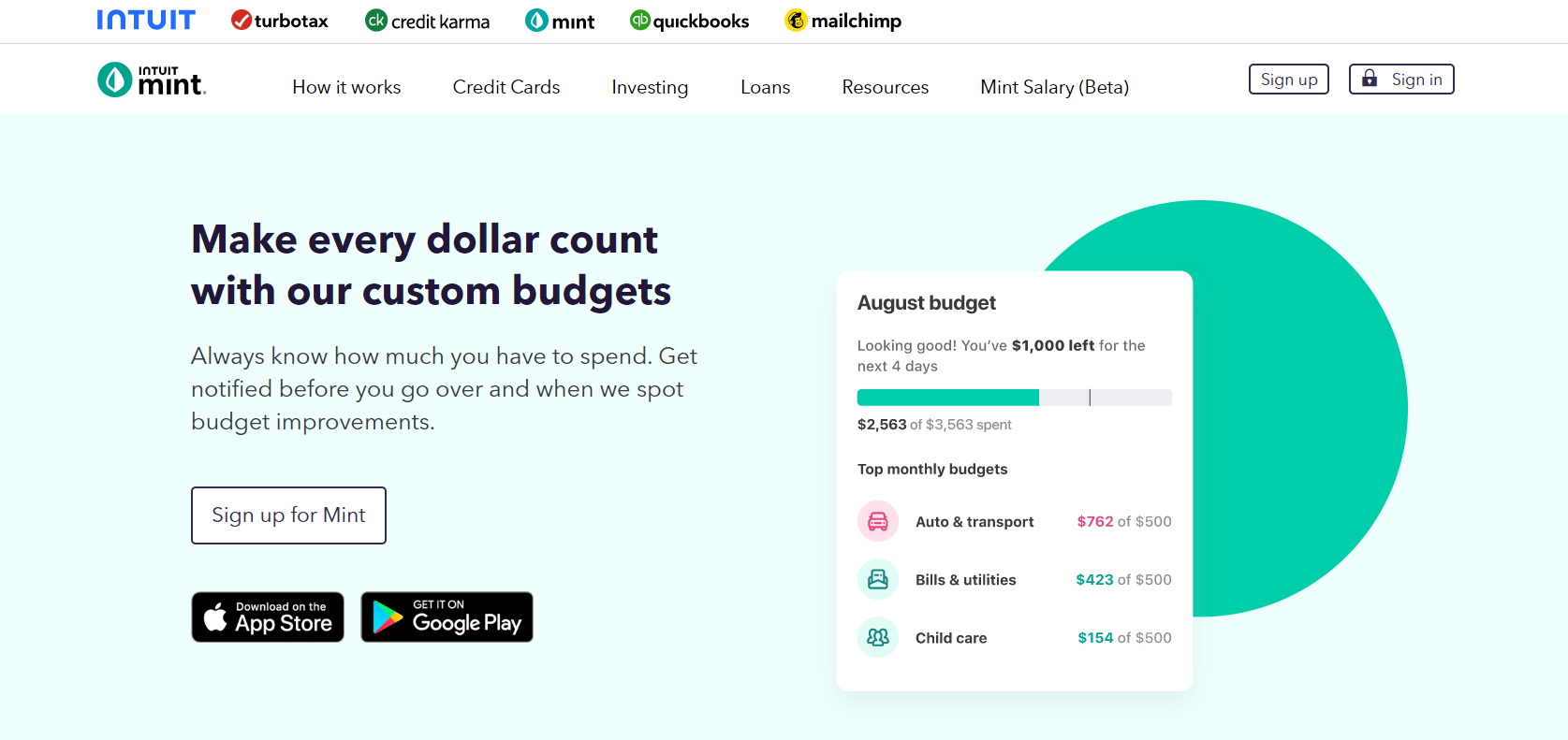

Budget Feature

Since both apps are concerned with budgeting, financial planning, and saving money, this has to be the most important point to compare the two. Now both these apps sync your bank account to get an idea of your spending on various items and as per that they build an estimated budget or chart where you can see all your spending on various items every month. Categories like food, rent, etc. are created. On Mint, values are assigned which can be changed if wrong and you can look at your monthly spending and also look at how much more you can afford to spend. Truebill on the other hand makes up a historical spending pattern and also calculates spending allowances for different categories to help you with budgeting. With the features being more or less similar the difference comes down to Truebill being a more mobile-friendly app while Mint is the same for desktop and app users. Also, Mint allows you to use all features for free whereas on Truebill you need to pay for the premium version or else you aren’t allowed to create unlimited budgets and neither custom budget categories. So considering everything the first point goes to Mint for being wholly free to use and offering more tools.

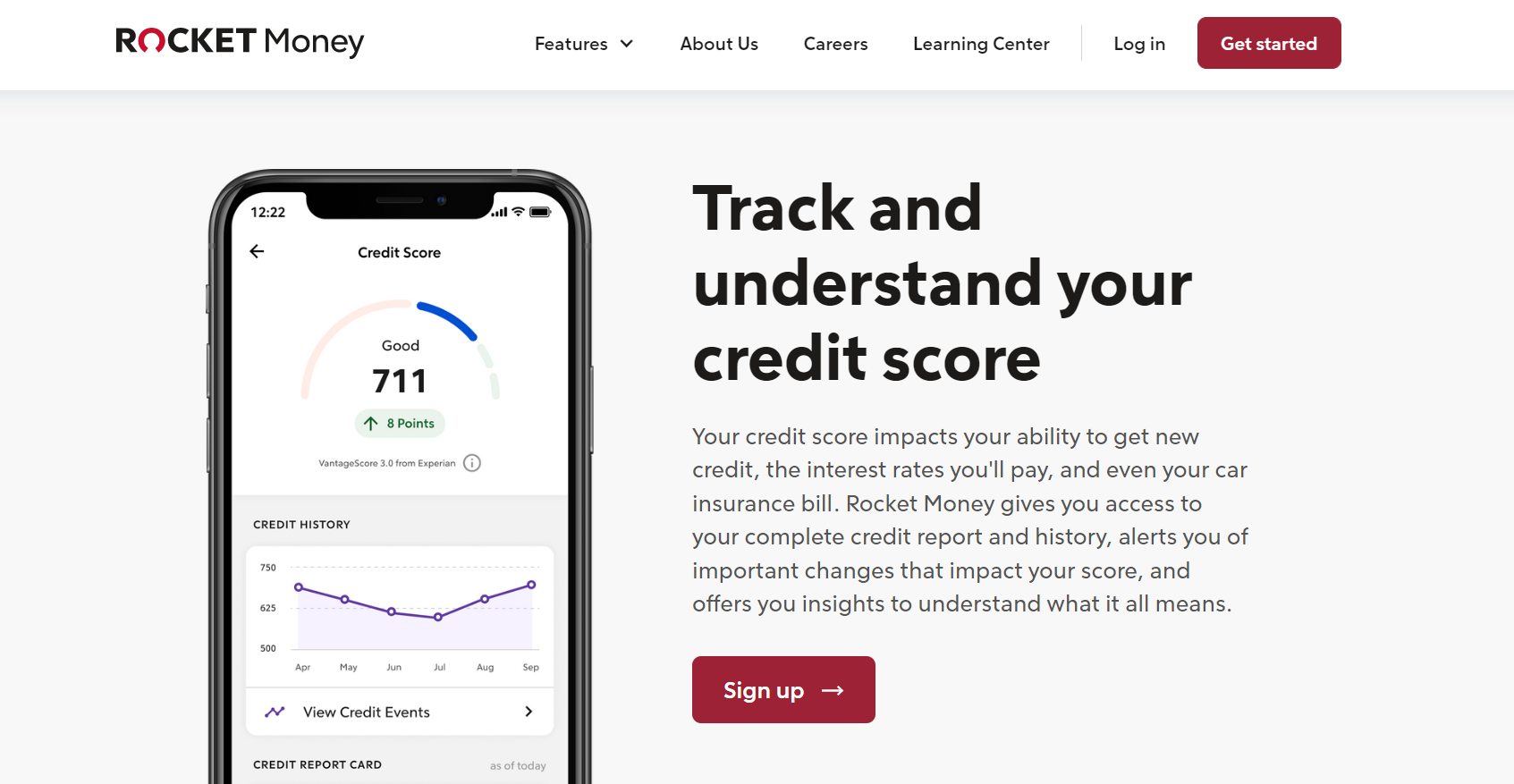

Credit Scores

Both apps let you check your credit score for free and monitor it. Mint, they have partnered with TransUnion and so you can check your credit scores for free. Also, whenever TransUnion sends Mint an update regarding the credit score the app informs you about the same. The same happens with Premium Truebill users who are alerted about credit score changes and can also get credit score reports to check. Again you see Truebill falls just short and the point goes to Mint because both apps provide similar features but Mint does it for free.

Savings Feature

Yes, budgeting is done but you also need to save money to make the app more useful. With Mint, all you have to do is choose a goal and work your way toward it, say you want to pay off your debt so you set that goal and start the journey to achieving it. Whereas on Truebill the process is broken down into finer pieces the app tells you your monthly income, how much is spent, how much is left, bills to pay, etc. The premium version of the app allows you to use more features where you can create more types of goals where you can use custom transfers or AI-based transfers to help you save money. This part of the Truebill vs Mint comparison seems more like a tie because Truebill offers more options but requires you to pay for the premium service.

Subscription

The Mint app comes with many features of which most are free. But is Mint free? Not totally, the app has a 4.99 dollar monthly charge which gets you an ad-free version of the app and gets you some more details and features. Through its partnership with BillShark, you also get access to bill negotiation services. On the other hand, signing up for Truebill Premium costs between 3 and 12 dollars which are charged as per their pay what’s fair model. Paying for premium gets you features like unlimited budgets and custom budget categories, premium customer support, AI-based saving feature, balance sync in real-time, credit reports, insurance info and bill cancelation service. More or less Truebill again would have won the battle because of its impressive range of features, however, Mint offers more range of features when the free version of both the apps are compared which gives them yet another point. So if we were to end the Truebill vs Mint comparison right here then there would be no doubt as to who emerges as the winner among the two. Being free while offering more services benefits Mint and helps it emerge victorious here, however, let’s look at a few unique features of both apps to see if Truebill has something more interesting up its sleeve to level the battle. Also Read: Yotta Savings Interest Rate, Fees, Review

Rocket Money vs Mint: Some Other Features

So with the Mint and Truebill comparison done for some of the common features, it’s now time for Rocket Money vs Mint based on their unique features. Let’s see if we have a new winner or the same old result here as well.

Rocket Money

While the basic premise of the app is helping you stick with a budget and save money the app is not limited to just that. Using this app you can use the app to highlight the subscriptions that you longer use but still pay for. Premium users get a concierge team that will look into it and cancel the subscription for you and helps you save money. You can also use the app to find yourself offers on bills, insurance, and other utilities. Here you upload the bill on the app and ask it to find you a cheaper alternative instead of a downgrade. This helps you save money on various utility payments but in return, you are charged between 30 and 60% of the savings amount as a success fee which you pay as per your wish. Lastly, Rocket Money also has a credit card that you can own if you are a premium member, and using this card you can build your credit score while keeping your credit utilization low. All these points make a good case for Rocket Money to win this comparison between Truebill vs Mint.

Mint

Mint won the comparison vs Truebill above based on just the common features but that does not stop it from having unique features ahead. There is more stuff that this app is capable of and we look at it below. If you have an investment account then the same can be paired with Mint so that you can track your investments or portfolio from this app itself. Also, the app has partnered with Coinbase which enables users to track their Bitcoin holdings through the app. If that was not enough then you can also track your net worth using this app once you have connected all your accounts to the app. The app can be used to set reminders for any incoming bill due dates or low balance in the account which then helps you avoid overdraft fees by cautioning you in time. Mint again does what it does best and gives you most of these unique features for free as opposed to Truebill which gives away the unique features to premium members only. However, the unique services offered by Truebill are better than just the additional tracking features offered by Mint and so Truebill marginally emerges victorious in the Rocket Money vs Mint comparison based on their unique features.

Is Mint Free?

As mentioned above, Mint and Truebill are both great finance apps that help you prepare a budget for yourself and save money. Both apps are available to download for Android as well as iOS users and are usable via the website as well, however, the apps are not wholly free. Mint repeatedly won battles against Truebill because of its features and because of being free which is why you might have the question: is Mint free? However, in the bigger picture, it comes down to the fact that most of the app is free to use. When you compare the free versions of both apps, Mint emerges as the better option as most of the features on the app are available to use for free. However, paying 4.99 dollars per month for Mint gives you access to certain added features which you afford to miss out on which is not exactly the case with Truebill, whose premium account is more of a necessity for access to some of the better features and that is why it feels as though the Mint app is as good as free. This is the reason the Mint app emerged victorious time and again in the Truebill vs Mint comparison.

Is Mint Safe?

Mint is an app built to manage your finances and this means money is involved. Also, you have to link your bank account to the app. So this brings the question of, is Mint safe, into the picture. This is an app that claims to offer you as much security as your bank if not more. The app has in place 128-bit SSL encryption and also monitors stuff for your safety using third-party sites like TRUSTe and VeriSign. Also after linking the bank account you have the option of setting up a PIN to enter the account on the app. Using this app also gives you the power to delete your account remotely using another computer or device if your primary device gets lost or stolen which helps you avoid so many issues. Also, your activities are remotely monitored and in case there is unusual activity on your then you are instantly alerted about the same so that you can take timely action. With all this in place, you can trust the Mint app to be safe and worried about your money as much as you if not more.

Is Truebill Safe?

Again we are talking about a financial service app and that means safety and security are a priority. And to give you just that the app has 256-bit encryption in place and the website also has an SSL certificate. The app uses the services of Plaid to connect to other financial institutions which means that there is a safe network that is used to access sensitive data. Also, the app claims not to sell your data to third parties. This should be enough to answer the question is Truebill safe, but there’s more. Also Read: Cash App vs Venmo vs Zelle: Which is the best?

Pros and Cons of Truebill and Mint

So far the battle has been mostly even with Truebill and Mint faring well against each other and Mint marginally being better. So the last roll of the dice sees us compare the pros and cons of both the apps to decide once and for all as to which app is better.

Pros

For Mint its biggest pro is offering almost all the features at no cost while for Truebill, premium users can negotiate their bills and ask for better rates which help them save money. You create custom budgets on Mint and also track your investment and Bitcoin holdings while Truebill monitors your monthly subscriptions and cuts subscriptions that you are no longer using. Mint is equally good to use on phones as well as a desktop and you can also track your net worth using the app while Truebill helps you with useful insights about your spending that you can use to improve your spending habits and save money.

Cons

The issue with Mint that a lot of users come across is that there are syncing issues that make the app undesirable to use and force users to go for its alternatives while Truebill’s biggest problem is that it asks people to pay for premium services that unlock the more useful features. Mint lacks in the area of providing features like bill cancellation and negotiation which are useful for an app of this nature while Truebill is not as good at budgeting as an app of this kind should be, especially with the free version. So if we look at the pros and cons of both apps then it is clear that in this Rocket Money vs Mint comparison again Mint fares better because it has the same number of cons as Truebill but at the same time it also has more pros.