Form 26AS includes information of:

Income tax paid by you The advance tax you paid Your self-assessment tax payments Regular assessment of tax deposited by you Refund received by you Your high-value transactions and investments like mutual funds, shares, etc.

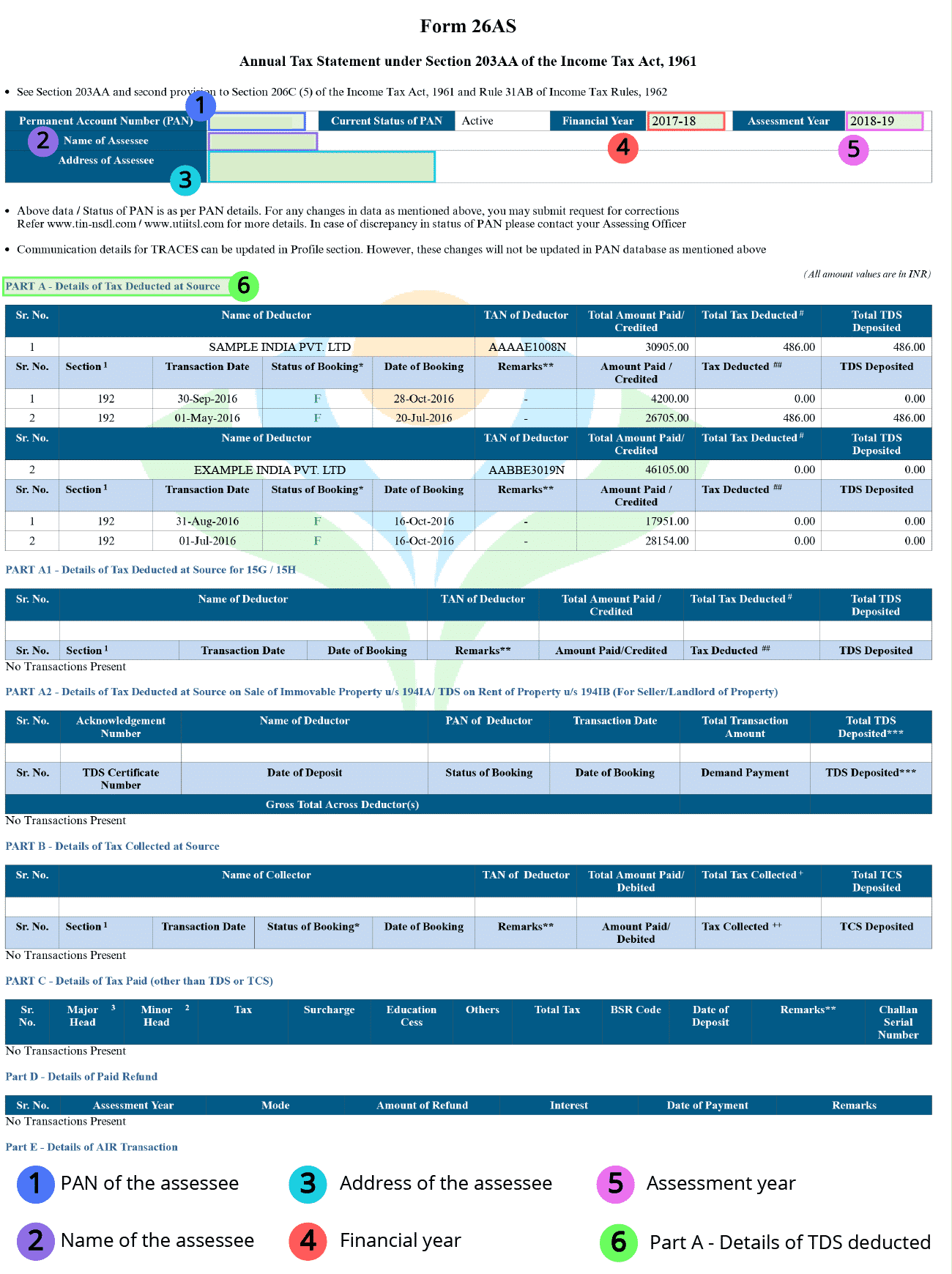

Structured parts of Form 26AS

The form 26As is divided into several parts for every financial assessment year.

Parts of Form 26AS:

Part A

Information on the Tax amount deducted from your account and all the details about your account. All the information related to your salary, interest income, pension income, and prize winnings, etc. Detailed information of TAN of the collector and the amount of TDS collected by him and deposited in the government tax account. This information got updated once in four months (quarterly basis). Part A1: For Form 15G/Form 15H Detailed information of income where there is no need for TDS to be deducted, but the taxpayer submitted Form 15G or Form 15H. If Form 15G or Form 15H has been submitted by you, then you can cross-check the status of the TDS deduction. If not submitted, then here you can see ‘No transactions present’ as it will be displayed. Part A2: It is for the seller of the property; here, you can find all the detail of the sale of Immovable Property u/s194(IA). If you have sold the property during the assessment year, then this is applicable, you will find all the related entries here.

Part B

Information on Tax amount Collected at the source by the collector. All your entries and details are present here if you are a collector, and tax is collected by you. It has detailed information about the tax collected at source (TCS).

Part C

Information of Tax amount Paid (Other than TDS or TCS) The detailed information of any tax you have deposited yourself will reflect here. Information on advance tax and the self-assessment tax are also present here. It has all the details of the mode of deposition of tax.

Part D

Information of Paid amount Refund You will get here all the details related to your refund. Financial Assessment year to which the refund is, the amount you paid, and interest you paid, along with your mode of payment and the date of payment, is also mentioned here.

Part E

Information of AIR amount Transaction All information of your high valued transaction is provided here like your mutual fund purchases of high value, property purchases, high-value corporate bonds, everything should be reported by your Banks and other financial institutions to the tax authorities.

Part F

This part is for the buyer of any property as it contains information of Tax amount deducted and all the details on the sale of immovable property u/s194IA You have to pay TDS if you have bought a property before making a payment to the owner. This section has all the information about TDS deducted & deposited by you.

Part G

Contains all the processing of TDS Defaults All the defaults related to the processing of statements and TDS are written here clearly but not has anything written about demands added by assessing officer or any provision like that.

Importance and Utility of Form 26AS

Few reasons why Form 26AS is important:

It contains all the tax-related statements, hence considered a very crucial document. At the time of filing return, it helps in estimating income and claiming the tax credit. It gives you ease in verifying income tax returns. Aids seamless and speedy processing of ITR and accelerate the credit of funds in your account. It gives you access to all the transactions and investments you have made in a financial year in one go. During the applicable Assessment Year, it helps in the verification of refunds. Gives crucial information about tax deducted from your account by the authorized deductor to be deposited to the government tax authorities. Reflects details of your Annual Information Return (AIR), which is filed by different entities based on what you have invested or spent on (any big transaction or mutual funds investment or share), mostly for high-value transactions. Helps you in keeping check of the accuracy of TDS and TCS filed by deductor on your behalf. It serves both the government authorities for tax and the responsible taxpaying citizens. If a taxpayer has form 26AS, then he need not attach a photocopy of the TDS document along with ITR.

How to see Form 26AS?

To see Form 26AS on the TRACES online portal and download it, you need to be a PAN holder. You should have a net banking account associated with any bank authorized to do it. Authorized bank means, your bank needs to be registered with NSDL (National Security Depository Limited). Also Read: How to Pay Income Tax Online: Steps to File Your Income Tax List of Indian bank registered with NSDL is:

Kotak Mahindra Bank Limited Karnataka Bank Oriental Bank of Commerce State Bank of India State Bank of Mysore State Bank of Travancore State Bank of Patiala The Federal Bank Limited The Saraswat Co-operative Bank Limited UCO Bank Union Bank of India Citibank N.A. Corporation Bank City Union Bank Limited ICICI Bank Limited IDBI Bank Limited Indian Overseas Bank Indian Bank Axis Bank Limited Bank of India Bank of Maharashtra Bank of Baroda

One can see the Form 26AS from the financial year 2008-09 onwards. See below the guide to download the form 26AS to view it. This form is linked with your PAN through net banking of your account in the registered bank. This facility is available online and is absolutely free. You can view it only if your PAN is linked with your respective account.

How to download Form 26AS? – Step by step guide

Here is a step by step guide to download the Form 26AS on the TRACES or via net banking facility of a registered bank. You need to login to your income tax department account there on their website for logging in you need to visit https://incometaxindiaefiling.gov.in. If you are not registered there and don’t have an account, then you need to register there first and continue further these eight steps. Step 1: To download the form, visit the E-filling website of the income tax department. Step 2: Enter your User ID, which is your PAN number, your password, and the captcha code available on the screen and then click on the login button. Step 3: After you have logged in into your account, go to ‘My Account’ and then click on ‘View Form 26AS’ in the drop-down menu provided there. Step 4: You see a confirm button here on this ‘View Form 26AS’ page. Click on that ‘Confirm’ button to proceed further to the TRACES website. Don’t worry about the security of your account or anything, as this is a government website laced with high security. Step 5: Currently you are directed on the TRACES website here you need to agree to the usage and acceptance of Form 16 / Form 16A generated from TRACES by checking the box available there and click on ‘Proceed’ for further processing. Step 6: At the bottom of that page you can see a link ‘View Tax Credit (Form 26AS) ‘click on that to see your Form 26AS Step 7: Choose the Assessment Year and the format of the Form 26AS in which you want to see it. You can see or download the form in PDF format after clicking on the button ‘View/Download’ available there below the format option. Step 8: You are asked for a password to open the document. Your DOB is the password in the DDMMYYY format.

Things to Verify-in Your TDS Certificate with Form 26AS

You must compare, cross-check, and verify the details in TDS and Form 26AS and make sure that the amount you paid as income tax is deposited in the income tax department account or not. In TDS Certificate Form, 16 is for salaried people and Form 16A for non-salaried people. Things to be verified are:

Check the spelling of your name and surname, double-check your PAN and deductors TAN. Check the amount you paid in TDS to whatever reflected on Form 26AS to make sure it is correct. Always confirm the figures and significant taxation information before you accept the document. As any mistake or mismatch will create a problem in filing the ITR and Will nag you during the whole process. Verify that the tax you paid is deposited in government account or not. If your deductor didn’t file the TDS and deposited your tax to the government on your behalf, then both of you will land in a problematic situation. So, contact your deductor and make him file your TDS and deposit the tax as early as possible. Must check whatever written on TDS certificate is also on your Form 26AS. Be sure that the TDS filed on your behalf is filed using your PAN; otherwise, it will result in lots of issues.

Also Read: 20 Tax-Saving Tips For Small Business Owners & Startups

Form 26AS Vs. TDS Certificate (Form 16/16A)

It’s quite tricky to understand why you need a TDS certificate or Form 16/16A when the same information is there in the Form 26AS. But the fact is that both serve their own respective purpose. You will get all the required information related to TDS in the form that is very much enough to file your ITR. Despite this, the TDS document has its own significance. The whole logic behind bringing this Form 26AS concept is to enable the taxpayers to thoroughly verify each and every detail mentioned in the TDS document and cross-check every minute detail and compare that to whatever mentioned in Form 26AS. The objective was to maintain transparency in the process. If you aren’t aware of these forms and documents and don’t have any, then it is very much chance of you being fooled as you will not be able to compare the details, cross-check it and find any miss-match in the documents that might have occurred. And if you have both of these documents, then you can easily compare, cross-check, find miss match and get it corrected or file complaints against any mischief.